Approved 2017 Health Insurance Rates by Rating Area

In May, the Insurance Department received rate filings for plans to be sold in 2017 on the federal marketplace at Healthcare.gov. The department reviewed these filings to ensure that rates were not excessive, inadequate, or unfairly discriminatory. For more information about rates and the rate review

process, please read our Consumer Guide to Health Insurance Rates and Rate Review or watch this video.

In order to better

understand the health insurance landscape in the state and options available to

consumers, the department has put together a

series of charts that show current 2016 premiums for the various plan options for

different people across the state and how the approved rates would affect

premiums available in the market. For more information on approved rates, visit

our health insurance rates page.

Marketplace open

enrollment begins on November 1, 2016. We encourage all consumers currently

enrolled in a Marketplace plan to return to shop on the Marketplace to

ensure that they have the best plan for themselves and their families.

Before you review final rates, please remember

the following:

- Premiums are not the same for everyone. A premium is the actual amount an individual or family will pay each month for health insurance. Premiums are based off of rates because insurance companies can vary premiums, to a limited degree, by where you live, your age, how many family members are covered, and whether or not you use tobacco. Each of these charts provides rates based on specific factors, including geographic area. Your rates may vary, to a limited degree, from those shown in the charts if you are a different age or if you use tobacco.

- If you are receiving a subsidy through the Marketplace, that subsidy may change to reflect changes in rates. Subsidies are based on the cost of the second lowest cost silver plan available through the Marketplace. If that second lowest cost silver plan premium changes, the subsidy will change accordingly. For example, if the premium of the second lowest cost silver plan in 2017 is higher than it was in 2016, you will receive a higher subsidy.

- Make sure you understand if and how your health insurance

is changing. Before open enrollment begins, your

insurance company will contact you to let you know if there are any changes to

your current plan. Make sure you understand any such changes, and remember you

can always explore your options or choose a new plan on the Marketplace. Even if the premium is the only thing that changes, you can still choose a new plan.

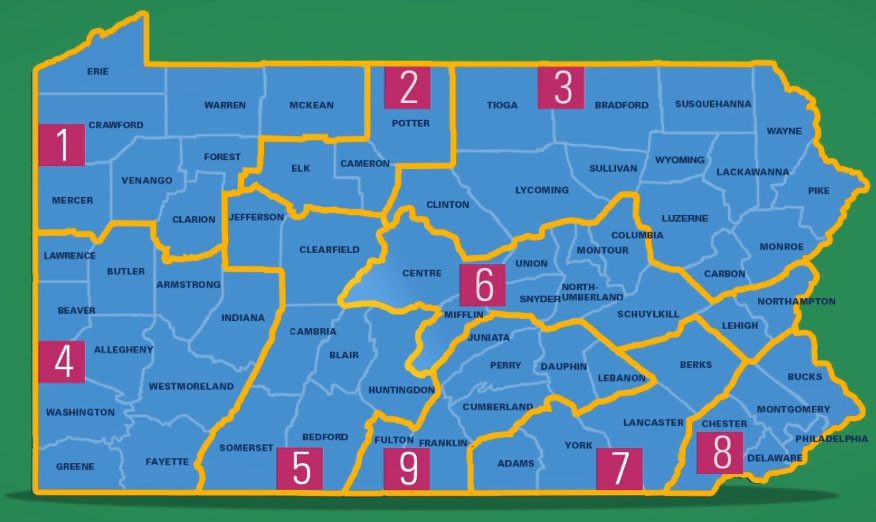

As mentioned, premiums can vary by geographic

area. For the purposes of health insurance rates, Pennsylvania has been divided

into nine rating areas and there is an individual chart below for each of those

nine rating areas. To see which rating area you live in, please view the rating

area map below:

To view premiums for 2017 and how they

compare to premiums from 2016 for specific insurance companies offering

plans in the rating area where you live, please click the link for your rating

area:

You can also view final premiums for all individual market plans

that will be offered in 2017 by downloading the Excel file below. You can sort

by rating area, county, insurer, metal level, and whether the plan is available

on- or off-Exchange.